Digi-Capital just published their VR/AR M&A report. Fascinating stuff, really.

Virtual reality mergers and acquisitions, it seems, is where all eyes are focused. Both AR and VR markets are scaling up, driven by demand and fueled by investment dollars. However, virtual reality M&A investment capital is not targeting market-ready products so much as the technology that will drive them.

As CEO of AppReal-VR, a VR development company, I’m exposed to startups in the AR/VR domain every day. Looking at some of the data Digi-Capital analyzed, I can definitely see the trend. I just don’t happen to like it.

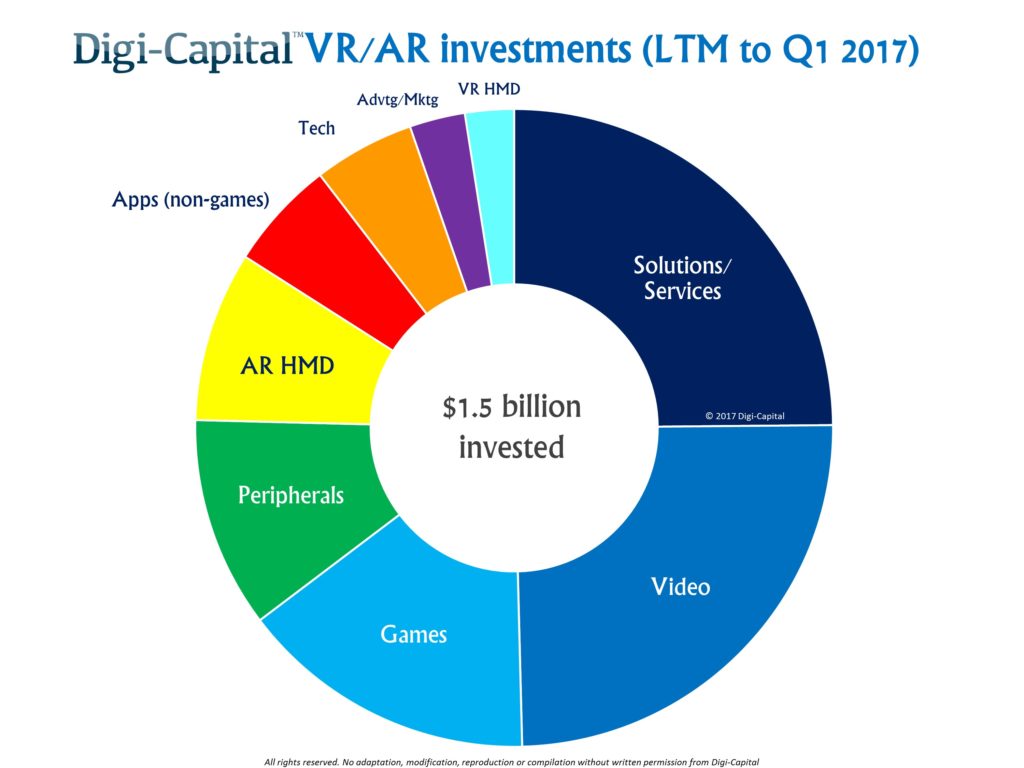

Digi-Capital VR/AR Investments (LTM to Q1 2017)

Source: Digi-Capital

Social Media Giants Eye Immersive Reality

Of course, Facebook, Apple, Snapchat, Google and all the social media moguls are all vying for their own piece of the emerging market. Whether it’s AR or VR (or MR, for that matter), every company wants their piece of the alternate-reality pie. Google launches the Daydream VR Operating System. Apple CEO, Tim Cook, declares that AR will be as “big” as the iPhone. Snapchat acquires Israeli tech startup Cimagine, developer of Markerless Augmented Reality technology. And Zuckerberg proclaims from the F8 stage that AR will be bigger than AR, with a little help from Facebook.

No surprise, here.

But while raw-technology companies are being acquired for their patents and intellectual properties, existing markets for VR headsets may suffer. Before immersive video and gaming markets had a chance to mature, it seems that the investment funds they need are being funneled into technologies that have yet to find a market.

For lack of sufficient M&A in the video and gaming space, some great companies with great products might not survive. Competition for the limited B rounds and C rounds of investments will naturally will be more fierce (which is good), but fewer companies with fewer products are likely to be left standing (which is not good).

And don’t tell me, I know that investors follow trends. But virtual technology has always been the forte of those looking for outliers, and so far it has paid off. We must remember, nobody’s stats were good when AR and VR companies started making real money.

My 5 Cents

So, I have a tip for entrepreneurial developers. It’s only about 5 cents worth, but you can leverage it into a percentage of market share if you try.

Do not be distracted by the trend for M&As to target technology rather than products. If you have the vision to carry your immersive product all the way to market, do it. In the next 1-2 years, Facebook and Google will absorb a few more technology companies, while many more startups will rot on the sidelines waiting for mega buyouts that never happen.

You, on the other hand, may very well be the one to feed the hungry market left that M&As leave behind.